“Choosing individual stocks without any idea of what you’re looking for is like running through a dynamite factory with a burning match. You may live, but you’re still an idiot”

Joel Greenblatt, The Little Book that Beats the Market

While it is easy to get lost in retirement planning and be satisfied with not knowing all the details, we know that’s why you’re not here. This is the next step in our journey. If you haven’t subscribed to our newsletter yet, please do so here so you don’t miss new tips and tricks!

In my previous article, we discussed the flaws of a traditional target date fund and why you should consider other options than buying into one. If you haven’t read that article yet, click here! After all, you’re an educated investor who performs due diligence right?

In this article, we will be going over how to build your own reverse target date fund (RTGF) since none exists in the market yet. If you’re not financially savvy, we do not recommend taking this approach since it does require annual rebalancing of the portfolio. If you’re not comfortable with this, we recommend that you stick with our tried and true solution mentioned here. Capiche? With that out of the way, here are the prerequisites before we can start building our RTGF:

- Brokerage account from the likes of Fidelity, Vanguard, Charles Schwab etc (we will do a comparison in the future. Stay tuned!). Depending on your age, you will have to choose between opening a Roth IRA or traditional IRA with that broker. Since I’m just starting my career, I’ll be using a Roth account. (don’t know the difference between a Roth and traditional? That’s coming in the future!)

- Spreadsheet program (Google Sheets or Excel works fine)

That’s it! We’re obviously assuming that you have a computer/tablet and internet connection otherwise this won’t work. We also don’t need cash to invest yet because this article mainly covers the planning stage. It helps if you already have cash on hand to invest because then you can immediately purchase the securities after you built your own RTGF.

Before we get our hands dirty, we must consider the risks. This allows us to build a RTGF tailored to our needs eg. if you’re older, your RTGF would be overweight toward equities. Here are some questions to consider and this by no means is a complete list:

- How old am I? Did I just graduate college or am I in the middle of my career?

- How much risk am I comfortable with? Can I tolerate extreme dips in the market or am I a more stable investor?

- Do I have enough savings? Could I expect to withdraw from my RTGF in the future due to unforeseen circumstances?

- How hands-on do I want to be? Do I like to keep up with markets on a daily basis or do I only want to rebalance my portfolio annually?

We will be addressing these questions throughout the process so don’t worry if you don’t have an immediate answer yet. Now let’s dive in.

Step 1: Determining the Glide Path

In the industry, target date funds adhere to a glide path, which describes how the portfolio is going to be allocated throughout the lifespan of the fund. A standard glide path that a lot of traditional target date funds use is 20-80, which means that initially the fund will consist of 20% bonds and near the end of the fund’s life, it will consist of 80% bonds (for more about how a target date fund works, read this). However, we will be taking the opposite approach as studies have shown that this has outperformed a traditional target date fund which means we will start off with 80% of the fund being invested in bonds and near the end of its life, the fund will consist of 20% bonds. These percentages can be adjusted for your risk tolerance, so if you’re more risk-adverse you can consider a 60-40 glide path where at the end of the fund, assets will consist of 40% bonds and 60% equity but we recommend sticking with the 80-20 glide path.

Step 2: Screen for Index Funds

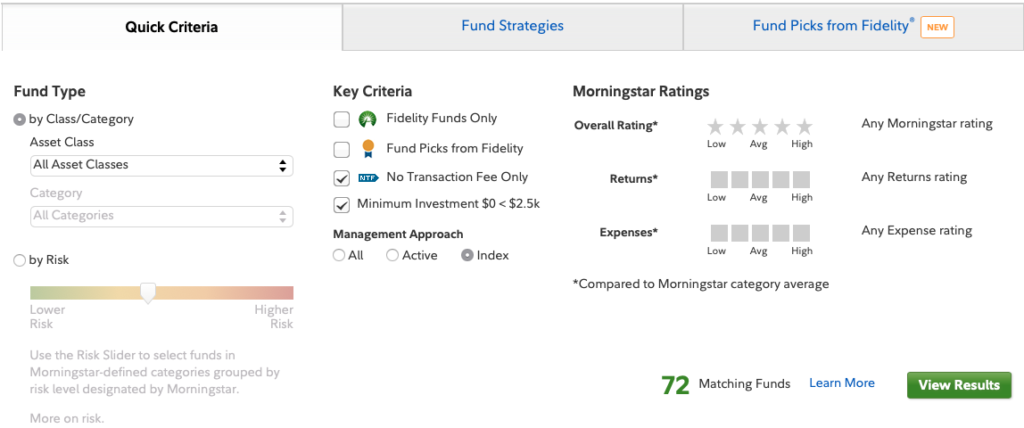

For the purposes of this tutorial, we will be using index funds to assemble our RTGF. If you’re a more active investor who wants to trade on a daily basis, consider using ETFs as index funds typically have a limitation on how frequently you can trade it per day. Now that you have determined what type of financial instrument you want to buy into, let’s screen for some index funds. Since I use Fidelity, I will be using their screener and buying their funds since they have the lowest fees. If you are using another asset manager, consult their help page on how to use their screener.

Here are the settings that I have initially inputted into Fidelity’s screener. This is taking a low-cost approach so I have selected no transaction fees and no minimum investment. Additionally, I have selected index for the management approach as index funds are usually cheaper than mutual funds that are actively managed. Now let’s look at the “Asset Class” field on the left.

When you click on the drop down field, you will be greeted by several options. These are the different types of asset classes you can invest in and they range from alternatives to bonds and equities. For the purposes of our RTGF, we’ll be sticking with Taxable Bond and U.S. Equity but feel free to add municipal bonds and international equities to your portfolio. Now let’s look at the results.

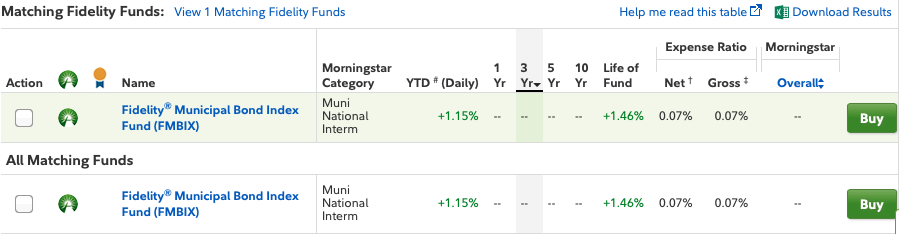

For simplicity’s sake, we screened for municipal bonds since there is only 1 result; that way I wouldn’t have to take a large screenshot and easy results like the screen above are easier to explain. I know what you’re thinking; there are too many numbers and I don’t know what they mean! Don’t panic! There are some simple things you need to know. Since we are a long term investor, we can ignore the 1 and 5 yr columns and just focus on the 10 yr and Life of Fund figures. These numbers tell you the return of the fund. Obviously, the higher the return the better but remember that higher returns are usually associated with riskier assets. If you’re retiring in 10 years, focus on the 10 yr column but for the majority of readers we’re probably retiring in several decades so we can really just focus on the Life of Fund column. Ignore the gross expense ratio on the right because we’re more concerned about the net expense ratio, which is what investors are ultimately charged after fee waivers and reimbursements. In the example above, a 0.07% expense ratio means that for every $1,000 you invest, 70 cents is taken annually from that amount for management of the fund. Thus, your effective dollars would be $999.30. Later on, we will use the total expense ratio for all our index funds and deduct that from our expected return to get our net return.

You should screen for at least 4 index funds; 2 bond indices and 2 equity indices as this provides greater diversification. Feel free to add more but keep in mind that the more index funds you add, the harder it is to rebalance the portfolio every year.

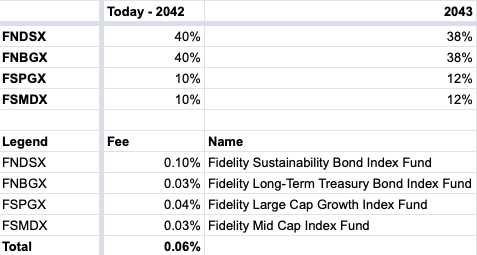

Above are the funds that I have picked using criteria consisting of which fund delivered the highest return while charging the lowest fees. Some things to keep in mind:

- Don’t obsess over fees! Yes it’s good to pay a lower fee but also keep in mind the return of the fund. If return – fee > return – fee of the cheaper fund, go with the one with higher return.

- Don’t obsess over crazy returns! Yes the whole point of investing is to earn a return but remember that this portfolio is always going to be changing as the fund approaches its target date which means that the total return of the fund will change as well.

Step 3: Build a Timeline

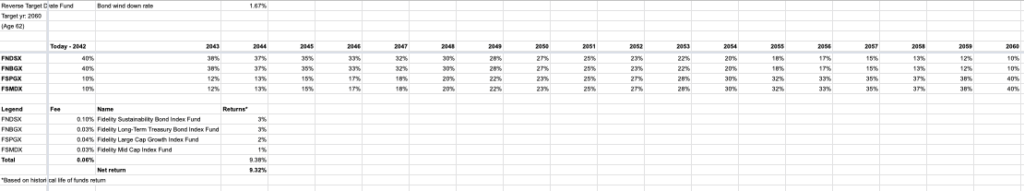

Once you have your funds selected, now it’s time to build a timeline. A completed timeline would look something like this:

Some key components of the timeline:

- Target date: obviously we need a target date, which represents the final date where we can start withdrawing funds. This date also represents what age you want to retire at so if you’re 40 right now and want to retire at 60, your target date would be 2040.

- Bond wind down rate: this rate represents how much of the bond allocation should shift to equities each year. A higher rate means that your portfolio would shift to equities faster. Keep in mind your target date since you don’t want to shift too quickly unless you’re comfortable holding a static portfolio for extended amounts of time. Typical wind down rates range from 1-2%.

- Glide path: don’t forget this! Remember that we have to allocate our portfolio. In the example above, we’ve allocated 80% of the starting portfolio toward bonds and the rest toward equity. These percentages will vary depending on your risk tolerance since my RTGF would be 80% equity and 20% bonds at the target date.

Step 5: Purchase Funds and Fund Maintenance

Hurray! Now that the hard part is done, all you need to do now is purchase your desired funds and rebalance the portfolio on a yearly basis based on the plan you just made. Remember that it takes discipline to stick with this plan but when you approach your target date, you will thank me later for achieving greater returns than a traditional target date fund. 🙂

Pingback: The Thrills of Speculative Investing - Crazy Finances

Pingback: The Value of Customer Service - Crazy Finances