Intro

Investing is something that everyone should consider. Having cash just sitting in a bank doing nothing is really only good for emergencies, but having your money work for you is important. We have all heard the stories of people making ridiculous trades and making boatloads of money and some people may think those people are geniuses and some think they are idiots. Just take a look at reddit/WallStreetBets and you can see just how crazy things get.

Even though I personally questions many of those trades made by people (*cough cough those tesla options), I think they may be onto something…

Diversification

One of the key things that many financial advisors will tell you is that you should always diversify your portfolio so risk can be hedged. I am all for that and if you have read some of our previous articles, we even created a balanced reverse date target fund to help diversify funds for retirement. There are many different investment types whether you decide to get into the stock market, real estate, private equity, etc. Having your financial assets spread out in different types of equity and industries allows you to reap benefits and cover losses in areas that might not be doing as well.

Having diversified assets in a portfolio is all about reducing the amount of risk and that is both a good and bad thing. If you are approaching retirement or are looking for a steady way to build wealth, you are probably looking to lower the amount of risk that you are willing to take one. Assets such as treasuries and AAA bonds may seem more appealing because they are stable, but the sacrifice is in smaller returns. On the other hand, if you are still far away from retirement and are more risk tolerant, you may be willing to try some riskier investment that could provide a higher rate of return. Those include investments such as junk bonds and penny stock which have large amounts of failures, but the successes can be quite impressive.

So What’s Up With Speculative Trading

Everyone’s risk tolerance is different so what I am about to say may cause you to split hairs.

Attention, this is just my opinion: I think everyone should consider having between 10%-20% of their investments be speculative in nature

What!?

Are you crazy?

Well I may be crazy but I’ll explain why this ideology of trying speculative investments can be great.

Many people consider an average yearly return rate of 8% year of year to be pretty good and I agree with that. The stock market has historically given returns around that and putting money constantly in the stock market to dollar cost average helps build wealth over time.

But, what if you could make more than 8% year over year? Get ready to expand your risk tolerance by a lot…

Speculative trades should not be a strategy used in determining most of your financial decisions, but trying to see if your gut instinct is right can pay off in big ways. Look at the news and see if there is a pattern that main street might be missing.

For example, before Covid 19 spread and hit the news like wildfire, the press in China was already covering it on a small scale. People who would have then shorted cruise lines, airlines and any sort of travel company would have made large sums of money by preemptively preparing for the worse.

The great thing about doing speculative trades is that you do not have to put in a large amount of money to get a large return. Options as an example can be bought for a fairly cheap price if you go out of the money, but can generate large returns because they are bought like a multiple of a stock x100 and can move with volatility among other factors. There will be many times where speculative investments do not work out, but…

“You only have to be right once”

Drew Houston – Founder and CEO of Dropbox

Additionally, there are many smaller cap companies that many retail investors do not touch because they are deemed to risky. Maybe you see something that the company is doing that could change the game that others haven’t seen and place a small bet.

Practicing What I Preach

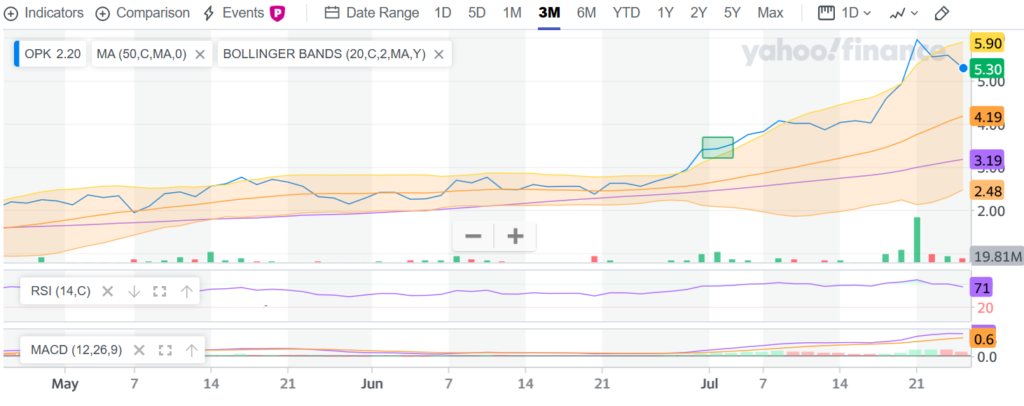

So I personally use this strategy when it comes to many of the stocks that I pick personally. Most recently, there have been many companies in the race to create a Covid-19 vaccine. Whoever creates that vaccine is going to have a huge amount of demand because the whole world needs it and governments and people are eager to snap up vials. But, what I am currently interested in is the companies that do testing currently because there is no vaccine. I decided to place a bet on OPK Health and bought in at the green box.

I have held it ever since because I think it can become a larger player in the testing space and as of this articles writing, it did just that through the announcement that they would be providing the Covid 19 test kits for the NBA. I am still holding on to this company as of this writing because the Covid 19 situation does not seem to be getting better, but the one bet that paid off has covered some of my lost bets.

At the end of the day, it is ultimately up to you whether the risk tolerance of speculative trading is up for you, but it can be a very rewarding experience. Especially when it comes to options where you can buy cheaper premiums that can yield large return. Here’s to all that like to speculate (#wallstreetbets).

Pingback: Everything You Need to Know about Options - Crazy Finances