Overview

Krispy Kreme is an 83-year old American donut and coffeehouse chain. The company conducts business via 2 main avenues; its fresh shops and hot light theater, grocery and convenience stores, and e-Commerce. The company also owns Insomnia Cookies specializing in warm cookies delivered directly to customers. Net revenues for the past 5 years has experienced a CAGR of 19.1% while points of access has only increased during the same time period (2016-2020). The company uses the Hob and Spoke asset model as its business model through partnerships, physical location expansion, and increased social media marketing to drive traffic to e-commerce sites.

Growth Strategy

Management has disclosed that the company’s growth strategy will mainly be via growth in Insomnia Cookies, expanding the omni-channel network, and driving efficiency to these channels. Additionally, the company identified a growth opportunity among existing customers as they currently visit Krispy Kreme less than 3 times a year. The company plans to continue innovating its products to improve visiting frequency via marketing efforts.

Risks

- Pandemics or other severe interruptions in foot traffic

- Changes in consumer preferences and demographic changes

- Heavy reliance on key customers in Branded Sweet Treat Line and DFD business channels

- Sensitivity to raw material prices

Financials

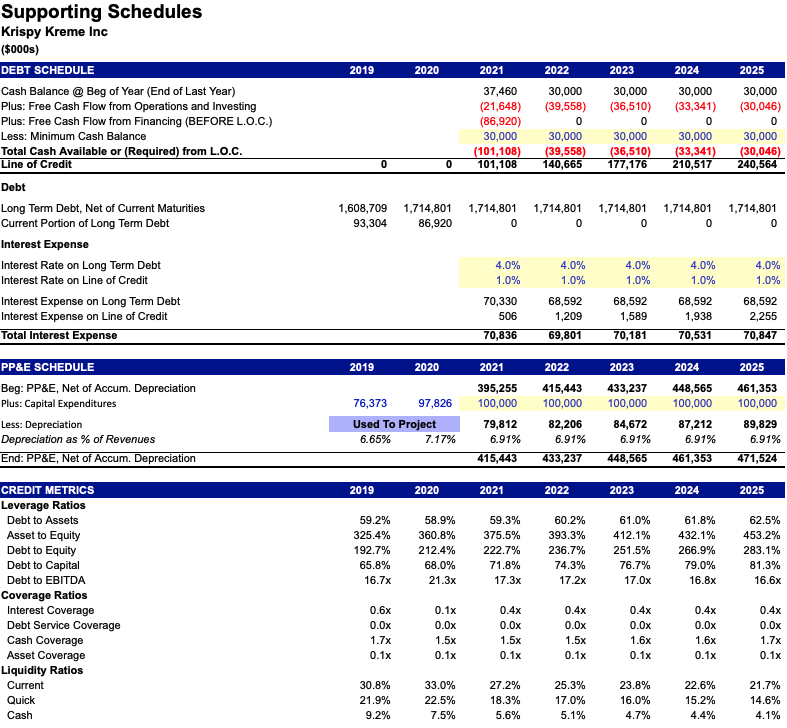

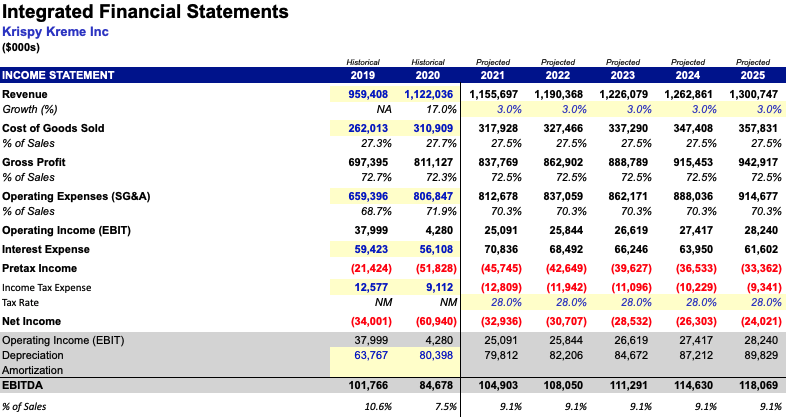

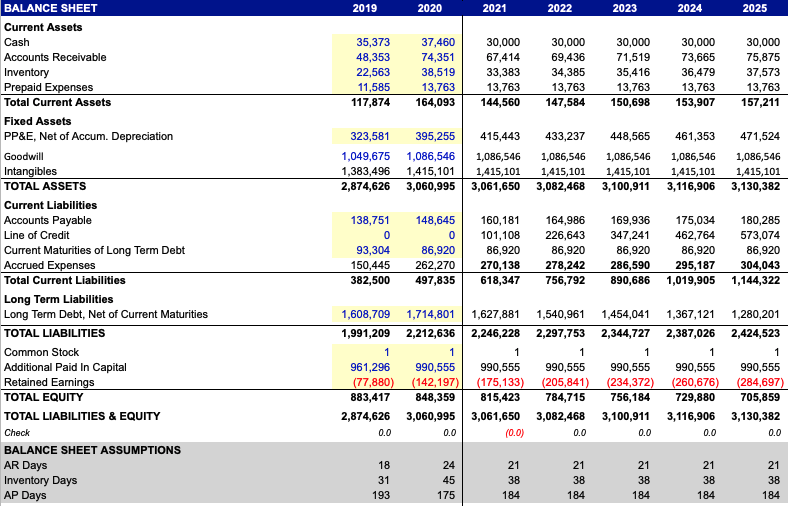

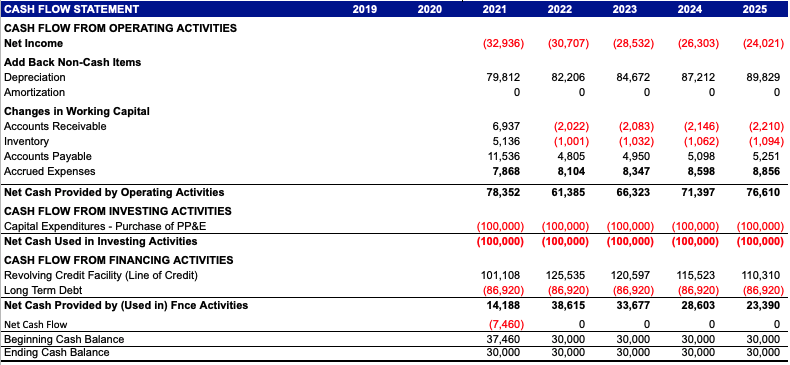

Financially the company is not in a good position. With a conservative YoY revenue growth rate of 3% assuming that margins remain flat, conservative capex requirements of $100MM per year, and even no current debt payments (which is an extremely optimistic scenario assuming that the creditors agree after negotiations), the company would still need to raise over $100MM in funding to meet its cash requirements. Cash is king for any business so while EBITDA may be positive, cash burn will cause the company to collapse unless if it can raise additional financing which would mean dilution for shareholders or an increased leverage ratio (see Appendix for leverage metrics). Leverage is already at ~17x EBITDA so it’s really concerning if the company plans on taking on additional debt.

Valuation

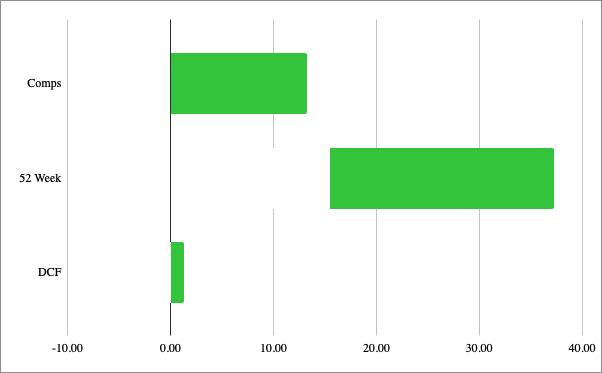

As you can see above, there seems to be a huge disconnect between its current trading price, represented by the 52 week low and high, and its valuation represented by comps and the DCF. We believe the intrinsic value of the company to be $1.35 / share which is a 93% discount from its current trading price of $19.29 / share as of 7/9/21.

Conclusion

Krispy Kreme is a nay from us. The donuts are good, but the company is not. The company has over $1B in debt (or ~17x EBITDA) from its earlier leveraged buyout of being taken private, and ever since its IPO the share price has fallen ever since. At its current share price, the company is valued at roughly $4B giving its former private equity owners a 4x return on their capital (WTF). What is this, a tech company??! Additionally, most of the proceeds from the IPO will be used to extinguish a large portion of the company’s debt instead of growth and capex. Given that cash flow historically has been negligible or even negative and projections only confirm this trend, it’s no wonder why its private equity owners are dumping this like a rock. If the company is unable to secure additional financing via debt or equity, operations will be severely impacted. This is a great deal for the private equity owners but I would not touch this with a 10 ft pole as a retail investor and I recommend the same to you.

Appendix