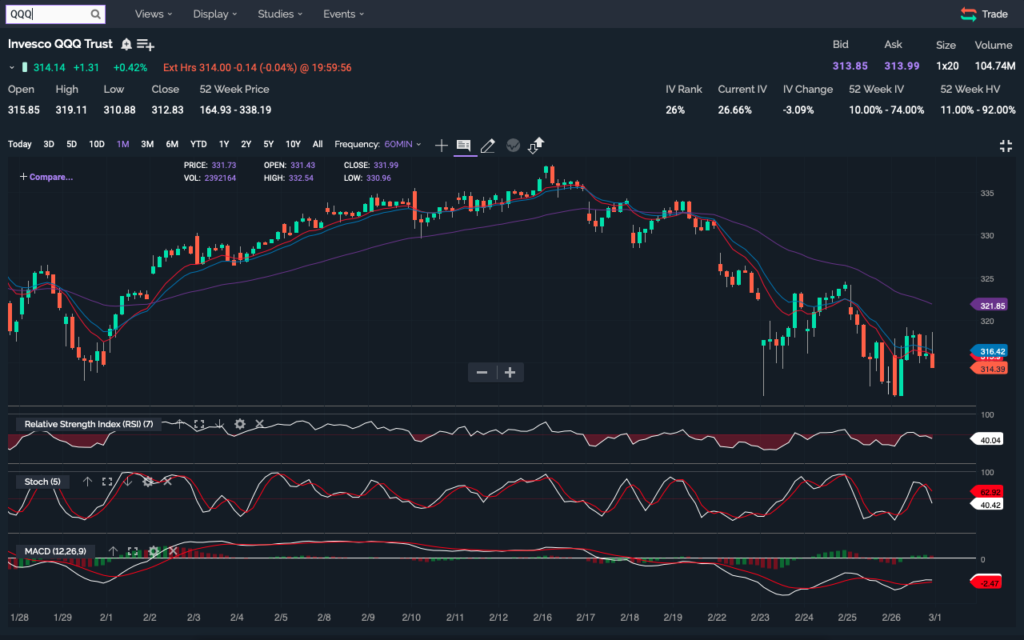

For those of you who have money in the market, you may have freaked out a bit seeing the drops happening due to rising yields of treasuries. Fear not, because these drops are only temporary and do not mean to sell. In fact, you should never sell especially if you’re investing for retirement. A simple index fund with compounding interest will reward you tenfold. We’ve even posted an article sometime back about how investing in QQQ would have netted you $1MM if you invested 20 years ago and held onto shares till now. This isn’t going to be a long article and I’m going to be sharing some charts to prove that we’re still not in a bear market.

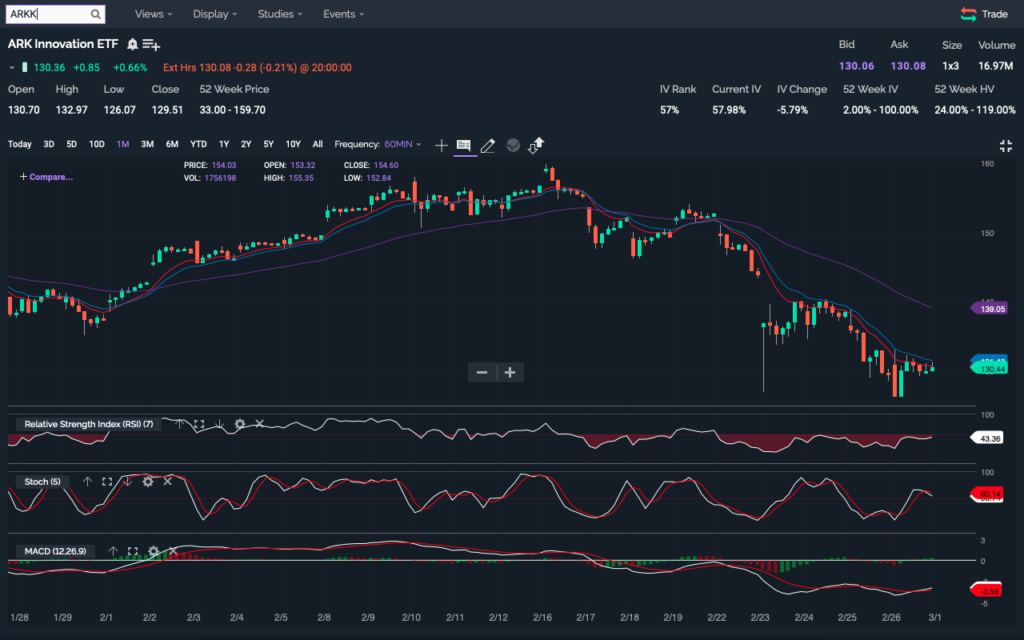

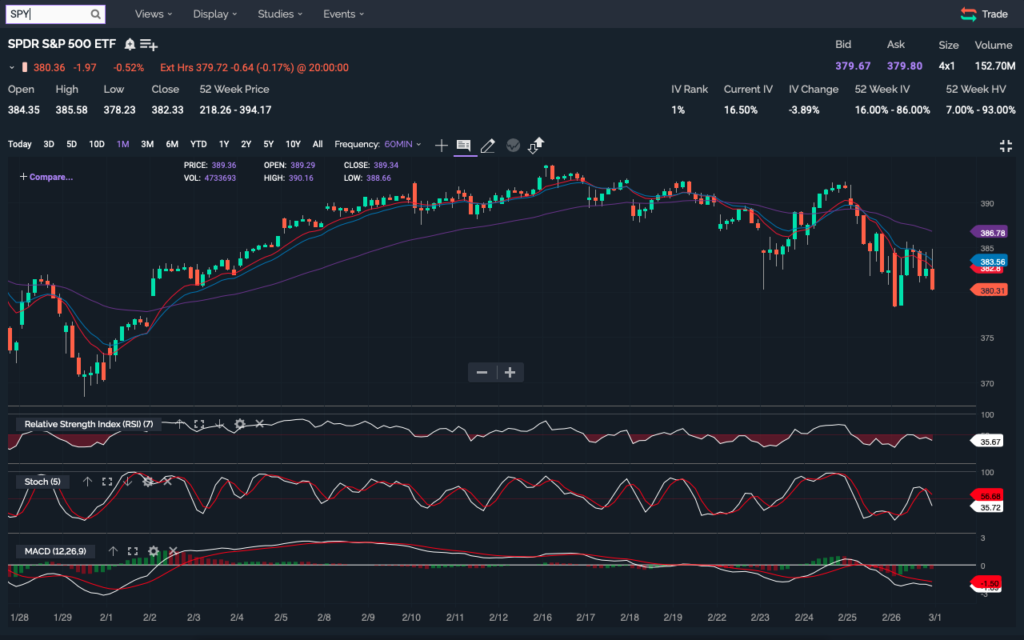

Did you notice any common theme in these 1 yr charts? If you noticed that the purple line is below the other lines in the charts, then you are absolutely correct. This purple line represents the 50 day exponential moving average and is one of the indicators used to determine if we’re about to head into bear or bull territory. I’m not going to get into a detailed technical lesson so all you have to know is as long as this line is below the other lines, then we’re still technically in bull territory. If you’re a long-term investor and you don’t plan to sell anytime soon, then just hold. In fact, it may be a good time to enter the market if you haven’t done so already. For short-term investors, continue reading on.

Now let’s take a look at these graphs on a monthly basis.

If you look at these 2 graphs above and have either been swing trading or writing monthly options, it may look worrisome. As you can tell, the 50 EMA line (purple) is above the 13 (blue) and 9 EMA lines (red). In fact, if you look closely you can see that the red line has pierced the blue line multiple times on 2/17 alone for QQQ and 2/17 and 2/22 both for ARKK. The purple line went underneath both lines on 2/18 for QQQ and ARKK indicating bearish movements on a short-term basis. This may be time to buy puts or for those of you who are more advanced to start opening put credit spreads or a bear call broken butterfly especially if you’re heavily invested in tech. You may be thinking about writing covered calls but be careful writing them in a short-term bearish market. The premiums for calls are probably not as juicy as they were before and the stock recovering would limit your gain. My rule of thumb is at the minimum the premium should be at least 1% of the spot price otherwise writing the option, either call or put is not worth it.

For speculators following SPY, you’re fortunate that it has only started to enter bearish territory. The purple line crossed both lines on 2/25 so if you’re swing trading or writing options on a monthly basis, it may be time to close out those bullish trades and take bearish positions as I mentioned above.

So what does this mean if I don’t trade options or don’t swing trade? Basically nothing. Continue holding onto stocks and if you’re bad with money (i.e. if there’s anything in your bank account you spend it), consider throwing your money into retirement and not looking back. The best time to invest is yesterday and the next best time to invest is now and you’ll thank yourself when you retire.