At this point, the question is a matter of when the stock market is going to crash instead of if. Since the pandemic has started, there has been a huge disconnect between the stock market and the economy which is why it’s important to remember that the stock market does not represent the overall economy.

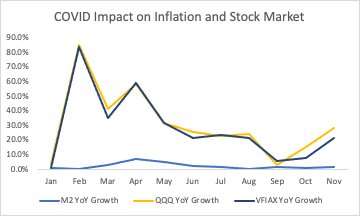

We all know that the stock markets tanked briefly during February and March of this year when the virus really started picking up steam in infection and death rates. Remember that central banks raise interest rates to prevent hyperinflation and decrease rates to promote growth and stimulus. Now take a look at the chart below for a monthly breakdown of returns from the S&P 500 and Nasdaq 100 vs. M2 money supply.

As you can see, stocks briefly rebounded after March although it hasn’t matched the astronomic growth rates as in the later months of 2019. The M2 spike in March and April may seem small in this chart due to axis distortion so let’s take a look at a historical yearly chart that spans back 20 years.

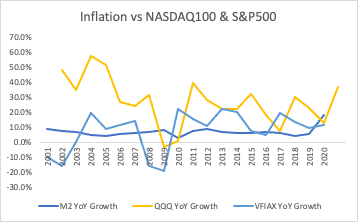

As you can see, there is a large spike in M2 money supply in 2020 due to quantitative easing from the Federal Reserve (Fed). This is also around the time when the Fed also started buying up corporate bonds instead of the typical treasuries when conducting quantitative easing. A spike in the Nasdaq 100 and S&P 500 followed, albeit the former had a larger spike.

So what does this mean for the average retail investor?

In the long term, nothing because we wrote a previous article that in 20+ years, corrections don’t really impact the portfolio as long as we don’t sell and continue contributing to our retirement plans. Of course, if you can time the market correctly you can take advantage of several percentages of gains but this doesn’t really impact the long term anyway unless if you consistently maintain similar gains across multiple years as a large loss in a single year could wipe out those temporary gains. If you’re an unsophisticated investor like I am, continue contributing to your retirement accounts. For sophisticated investors, continue reading.

What does this mean for a sophisticated retail investor?

Don’t take the following to heart as these are my best guesses and as always, do your own research and due diligence. There are two scenarios that I see playing out; either the Fed raises interest rates to prevent the market from overheating (scenario 1) or we enter a similar period to Japan with low interest rates but also moderate to low growth (eg. a period of stagnation, AKA scenario 2). Realistically, I believe the former is more likely because we have still experienced growth despite the pandemic.

Scenario 1: Fed raises interest rates

If I were to attempt to time the market, I believe that there will be a correction in 2-3 years when the Fed has no choice but to raise interest rates. Before we delve in let’s remember the basis: central banks must raise interest rates to prevent hyperinflation which is the whole point of this article and was mentioned earlier. So what will happen when interest rates increase?

Banks and financial institutions experience better financial results. This is because an increase in interest rates would yield better returns for banks on their loans (for simplicity’s sake, I’ll use the word “bank” to refer to all financial institutions in the lending space as there are BDCs and firms in the private credit/leveraged finance space but for the purposes of this article, “bank” refers to all these players despite some of them not really being a “bank”). Remember that banks are not typical companies and their balance sheet is flipped; debt is an asset and cash is a liability. We may even see banks get away with charging more fees during the underwriting process of loans. Of course, this only works if the bank is also able to collect its principal back otherwise the interest income won’t be worth it.

I’ll admit that I’m not super experienced in this space but I am working in leveraged finance. Considering that this is anecdotal, several portfolio companies have violated covenants resulting in their entrance into default status. This doesn’t mean that the companies have gone bankrupt per se, but there has been an increase in restructuring. For those of you in investment banking, it’s no surprise that we’ve seen an uptick in restructuring deals. Despite a lot of publicly traded companies being over leveraged, I do not see the larger firms going bankrupt. Most likely, small cap companies are going to be hit harder that mid and large cap firms. Debt is going to become more expensive but on a large cap perspective, I don’t see many bankruptcies which is why my personal portfolio only has large and mid cap exposure.

Believe it or not, this is the better scenario of the two as growth is still expected albeit at a lower rate as companies may reconsider borrowing more expensive debt. These companies will be forced to adapt in a more expensive debt environment but I have no doubt that the majority of large and mid cap companies will survive. Now let’s look at scenario 2.

Scenario 2: Fed artificially maintains low interest rates

In this scenario, the Fed predicts that the economic crash will be much more severe than the Great Depression and decides to forgo an interest rate hike effectively spreading out the “recession” over multiple years. This would translate to a low-interest rate environment where growth is stagnant and bond yields are unattractive. This has already happened in Japan, AKA the Lost Decade which officially spanned from 1991-2000 although commentators have expanded this out to 2020 due to the continuation of low growth. In my opinion, this would be the worse scenario since in Japan GDP fell about $1 trillion ($5.33 to 4.36 trillion) in nominal terms, real wages fell about 5%, and the country experienced a stagnant price level. In the United States, we’ve already seen stagnant wages so a period of stagnation in the U.S. would be brutal in terms of forgone gains. There is a debate whether the Japanese central bank made the right move in spreading out the recession over two decades (one side could argue that this prevented retirement and pension plans being wiped out and that low growth is a better alternative) but scenario 1 would be worse for those who have a significant position (we’re talking about those who have hundreds of thousands already in their retirement savings) in equities and bonds. To mitigate this risk, I recommend investing in emerging and/or international markets.

If the economy crashes anyway instead of entering stagnation, this would be known as a liquidity trap as the Fed is unable to lower interest rates further as it is already close to 0. This also happened in the Japanese scenario (although it was not a crash) which means that the central bank was not able to stimulate the economy. This would be the absolute worse case scenario because a paralyzed Fed and an economic crash would result in lost jobs, income, and spending. I highly doubt this will happen but the best way to mitigate against this risk is to hold actual precious metals (AKA not in an index) such as gold.

Similar to Japan, we may see a 20+ year period with low growth and interest rates where domestic stocks and bonds are unattractive if the Fed picks this option.

Conclusion

As a long term investor, disregard both scenarios and continue investing as I highly doubt there will be an end to civilization as we know it and we all survive on gold. Either way, the world as a whole is going to recover from this pandemic so if you believe we’ll enter scenario 2 consider increasing your emerging and international equity allocation.

Pingback: Stimulus Package Impact on Stock Market - Crazy Finances

Pingback: Student loans; Uncle Sam’s Mirage - Crazy Finances

Pingback: Why Value Investing is Dead - Crazy Finances

Your weblog is excellent. Thank you greatly for delivering a lot of very helpful information and facts.

Several with the points associated with this blog publish are generally advantageous nonetheless had me personally wanting to know, did they critically suggest that? 1 point Ive got to say is your writing expertise are excellent and Ill be returning back again for any brand-new blog publish you come up with, you might probably have a brand-new supporter. I book marked your blog for reference.

Hmm. I see exactly what you mean. Hey, would you happen to have Feed? Im attempting to subscribe in order to get updates. Tell me. I really enjoy reading your site! Should you keep making great posts Ill return every single day to keep reading!

Sure thing! You can sign up here.

I every time spent my half an hour to read this weblog’s articles or reviews every day along with a mug of coffee.

I really to find more on this subject I have sbuscribe to check. Also, splendid article. I want to read more of the columns on this wonderful website. more power and goodluck

I am writing to let you be aware of what a really good encounter our daughter experienced viewing the blog. She came to find numerous pieces, including what its like to have an awesome teaching mood to have many people really easily fully understand a number of problematic subject matter. You truly exceeded readers expectations. I appreciate you for distributing these good, trusted, explanatory and as well as unique thoughts on your topic to Janet.

You have some honest ideas here. I done a research on the issue and discovered most peoples will agree with your blog. After that early period, the Beatles evolved considerably over the years.

It’s going to be ending of mine day, except before finish I

am reading this wonderful paragraph to improve my know-how.

Great site! I come here all of the time! Keep up the great work!