If you’ve been keeping up with the news recently, it’s clear that Joe Biden has won the presidency in this historic 2020 election – there’s no doubt that in several decades time that Trump’s four years and this election will be covered in APUSH. That leads us to the question – how will a Biden administration impact our economy? First thing we have to remember is that just because he says something on the campaign trail doesn’t mean that he’ll actually implement these ideas in reality or at least without resistance from Republicans in Congress.

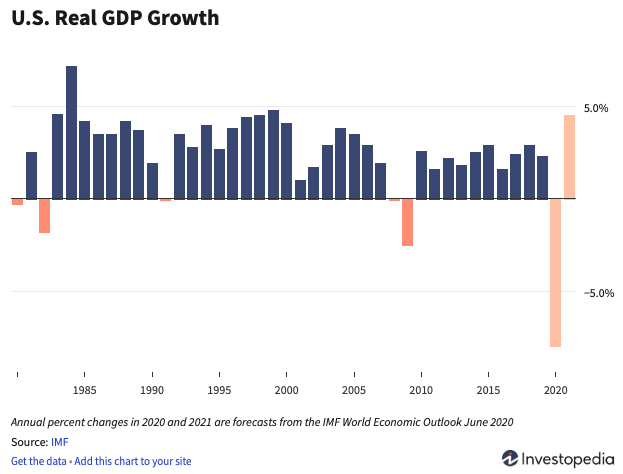

To refresh ourselves, let’s first look at how the U.S. has been doing in the recent years by looking at real GDP growth:

As you can tell, we’ve taken a big hit in 2020 due to the pandemic. The effect of the pandemic on our economy is a lot worse than the 2007-2008 economic crisis caused by subprime mortgages. The IMF predicts that our economy will rebound in 2021 resulting in a 5.0% real GDP growth. However, keep in mind that for every day that passes without a vaccine a V-shape recovery is becoming less likely. If you ask us at Crazy Finances, we believe conservatively that growth next year will actually be 2.5% or half of the IMF’s prediction corresponding with a K-shape recovery where some businesses will succeed while others will fail. This is already playing out as we’re seeing a lot of service-based businesses such as restaurants shut their doors permanently. This is no doubt exacerbated by the fact that Neel Kashkari, CEO of Federal Reserve Bank of of Minneapolis stated that the U.S. should be prepared for 18 months of rolling lockdowns across the country as we stem infection rates.

Now comes the million dollar question (or maybe the quarter of a million cases phrase is more appropriate), how is Biden planning to tackle this problem as he inherits a shattered economy with a stock market pumped up by qualitative easing?

To summarize, Biden is planning to introduce infrastructure bills worth more than $1 trillion (hello Caterpillar!) with some nuances; specifically the Republicans don’t want infrastructure spending in coronavirus stimulus bills while the Democrats do so we should keep a close eye on the Georgia runoffs and how the final Congressional makeup will look like.

Biden’s $1.3 trillion bill will be spread across a decade with $400 billion allocated to clean energy research and implementation, $100 billion to modernize schools, $50 billion in repairs to roads, bridges and highways in his first year in office, $20 billion in rural broadband infrastructure, and $10 billion for transit projects that serve high-poverty areas with limited transportation options. Before you go off and buy stocks in these related sectors, keep in mind that all these initiatives require Congressional approval and that there’s no such thing as free lunch – one way or another this is going to come back to either us or corporations in a form of a large tax bill or the U.S. dollar suffers inflation. If Republicans retain the majority of Congress, corporate tax hikes are unlikely which means that earned income and other taxes will increase – bad news if you’re an employee. If Democrats gain the majority, the likelihood of corporate tax hikes increases but this may negatively impact stocks which would hurt retirement accounts. We may even see increasing wealth gaps which were already worsened by the 2007-2008 economic crisis. See below on how much tax revenues make up of GDP.

On trade, don’t expect the U.S. to cozy up to China just yet. Biden has announced that he wants to form a coalition of allies to apply pressure on China to curb intellectual property theft. We may see an increasing trade deficit but in my opinion trade deficits don’t matter and that we should adopt more neoliberal policies and promote free trade and open borders as studies show free trade positively impacts the economy on a net basis (I won’t get too political – I promise).

I know that’s a lot of data, but what does this mean long-term on your portfolio? Basically it means nothing. As long as you continue buying index funds, you’re good to go. Of course, if you own an active portfolio of stocks and bonds consider allocating to emerging markets if you haven’t already. Diversification is key and that applies to geographies as well, not just industries. The key theme under the Biden administration is rising tax rates for high income earners and corporates so don’t be surprised if we see companies leaving the U.S. and an increased reliance on the service economy.