Company Description

Comfort Systems USA (NYSE: FIX) is a B2B, end-to-end service provider of building systems including plumbing, HVAC, and electrical services. Its services cover both new construction and maintenance initiatives. Currently, the company has 35 subsidiaries in over 140 locations across the U.S. We believe that the company’s strong financial profile, competent management team, and solid long-term growth perspectives make this stock a “Yay”.

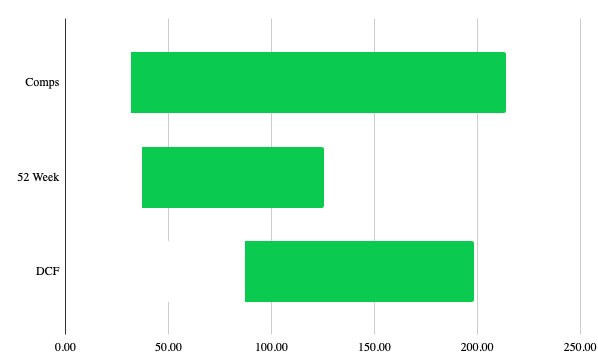

Valuation

Using comparable companies and the DCF model, we believe an appropriate range for this stock is $32 – 115 per share. We’ll discuss how we arrived at this valuation below.

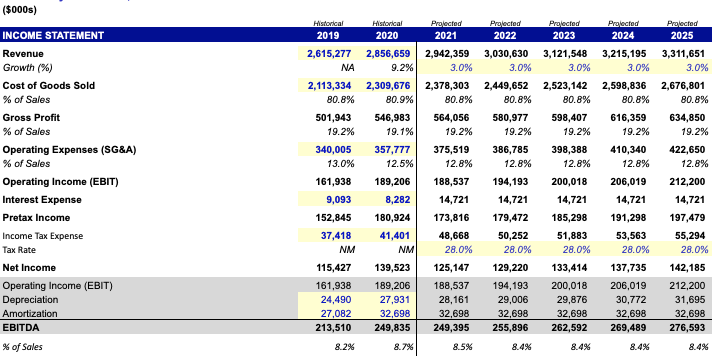

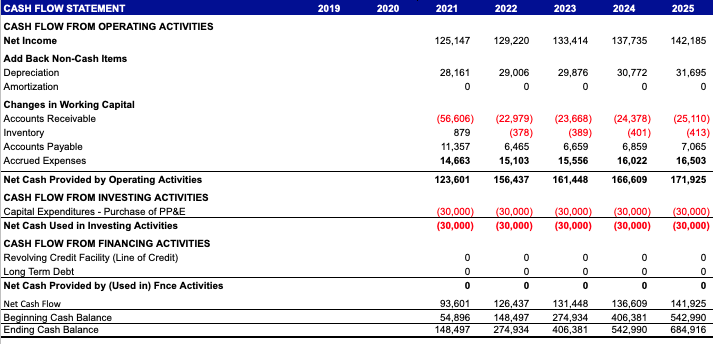

Financials ($000s)

The company has a healthy balance sheet and solid financials. Debt currently makes up 35% of the capital structure which is a healthy amount to continue operations while taking advantage of its tax shield status. As of FY2020, the company maintains a current ratio of ~1.5 meaning that it can meet its short-term obligations.

On the Income Statement, the company has maintained a historically healthy 8% EBITDA margin with close to $3B of sales in FY2020. YoY sales growth from 2019 to 2020 was 9% and our conservative projections of 3% YoY sales growth still indicate that the company is undervalued.

This results in a strong levered free cash flow generation profile, which generates ~$100MM annually. This is after including a conservative capex spend of $30MM per year.

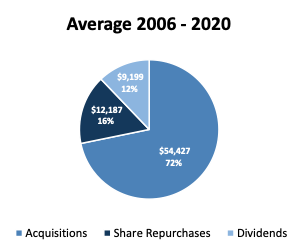

Additionally, the company has been free cash flow positive for a consecutive 22 years and increased its dividend 8 consecutive years. Because of its conservative capitalization management, the company has roughly ~$700MM in debt borrowing capacity. This is a financially sound business with healthy margins, balance sheet, and strong free cash flow generation characteristics.

Customers

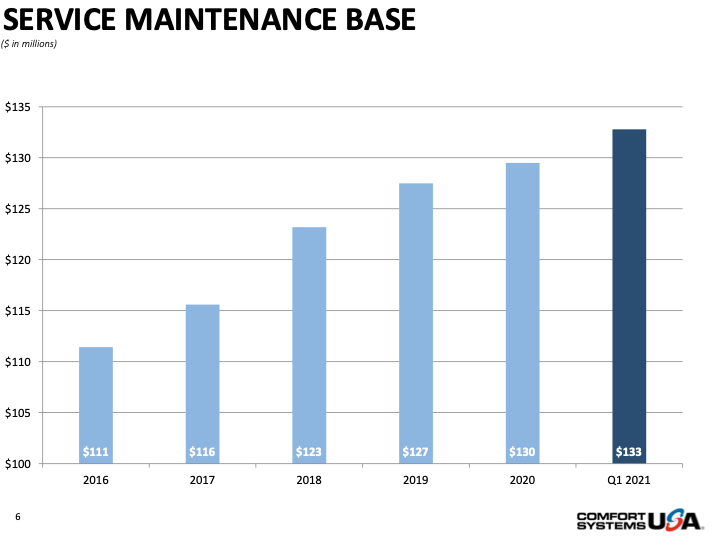

Comfort Systems is an example of a boring yet essential business. No matter what, buildings will need air conditioning, plumbing, and electricity. While there are smaller mom and pop shops in the space, Comfort Systems has economies of scale and is able to secure long-term contracts with customers rather than collecting a one-time payment similar to a mom and pop shop.

Growth Prospects

The company has historically aggressive pursued M&A, resulting from an initial 12 companies under its umbrella in IPO to 35 companies today.

While management only disclosed in their latest earning call that they’re currently waiting on the right time to make another purchase, it shows that a robust M&A strategy and inorganic growth development are crucial to its long-term strategy.

Current trends in the space are in industrials, indoor air quality, services, and modular construction. The company has a solid foothold in pharmaceuticals, tech (data centers require extensive cooling), institutionals, and manufacturing.

Management

The company’s management has on average 10 years of experience at Comfort Systems and 35 years of experience at other firms. The CEO has extensive history in the energy sector and was previously responsible for sales and strategy at Halliburton. We believe that the long tenures of management have ingrained a long-term mindset. A local article sums up management beliefs with its CEO, Brian Lane, stating during the pandemic to “focus on your customers” and “take care of your people as best as you can”.

COVID Impact

The company has been hit by COVID resulting in an 8% reduction in its workforce. However, the company has bounced back driven by demands in electricity, plumbing, and HVAC systems from technology, food processing, and pharmaceutical companies. These sectors benefited from the pandemic with e-commerce expansion and remote working along with the race to produce vaccines. This resulted in a 9% YoY revenue increase from 2019 to 2020.

Risks

- Increased raw material costs

- The company relies on raw materials such as sheet metal to manufacture its products and increases in raw material costs can impact margins. It is currently unknown how much the company can pass cost increases to its customers.

- Labor shortage

- The company is currently having challenges finding experienced technicians such as plumbers, HVAC specialists, and electricians. This could impact margins through wage increases and hamper future growth. We believe this is temporary as the bulk of these problems should be resolved once stimulus ends.

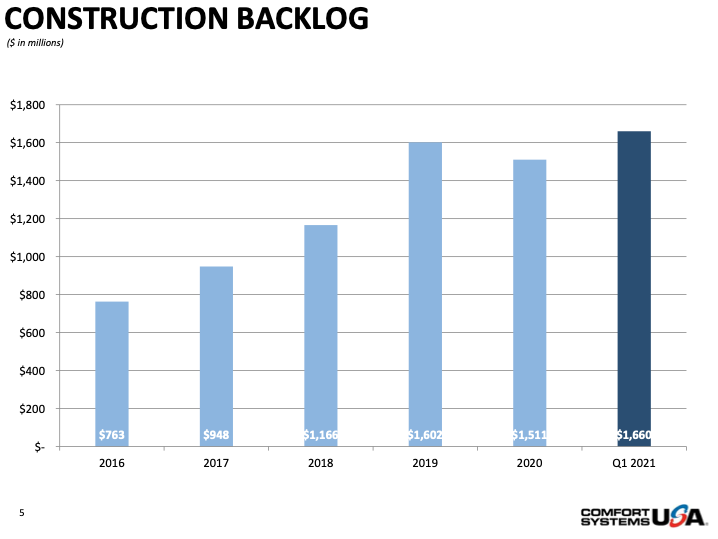

- Concentration risk

- The company has significant customer concentration with ~70% of revenues tied to construction. This risk is mitigated through its strong backlog. As of Q1 2021, this backlog is roughly ~$2B.

Conclusion

After considering the merits and risks of the investment, our 5 year price target is $111 a share, which is in our valuation range (see chart above in Valuation section). This is assuming a conservative 3% YoY growth with EV/EBITDA margin expansion from its current 11.2x to 16.0x. This represents a ~40% premium to its current trading price of $80.26 a share. With capable management, strong financial profile, and solid growth prospects we believe this is a severely undervalued and overlooked company.

Appendix