There’s no such thing as the perfect portfolio, but we sure can build a simple one that can last the test of time.

There are many different approaches, but for this example, we are going to assume the following statements based on historical data (but no guarantee on future returns).

1.Stocks generate higher yields than bonds

This fundamental belief is based on decades of historical performance but also because stocks are more volatile compares with bonds. The stability of bonds do not generate the high yield of growth that stocks can, but stocks do come with more volatility.

2.Small cap probably outperforms large cap in the long run

Smaller companies have more room to grow (economies of scale) but there is inherently more risk. Those that make it grow to mid cap then large cap.

3.Risk vs return are highly correlated

Builds upon the idea of stocks outperforming bonds. Additionally developing countries have high growth potential, but because of the higher risk, returns can be volatile

4.The US market will not always be the best performer, but is currently the gold standard

The past couple of decades have shown the US market as a clear leader but no empire is number 1 forever.

Because of this hypothesis, the 3 etf fund portfolio mix we will be describing will only have stocks and no bonds. As you approach retirement, you could switch into bonds, but we’re going to go really lazy. Additionally, instead of rebalancing the allocations of the portfolio every year, we are going to assume you just put in money at preset allocations every year to keep is really simple. Simplicity and solid gains are key here.

So, without further ado, the 3 ETFs are as follows:

Vanguard Total Stock Market ETF (VTI): This ETF provides exposure to large, mid and small call US stocks. It has a low expense ratio and is a good way to invest in the overall health of the US economy because it is US only.

Vanguard FTSE Emerging Markets ETF (VWO): This ETF provides exposure to emerging markets such as China, Brazil and South Africa through large and mid cap equity exposure. This fund also includes China A shares which is great to get exposure into Chinas rising economic powerhouse.

Vanguard FTSE Developed Markets ETF (VEA): This ETF provides exposure to developed markets in places such as Europe and Canada through large, mid and small cap equity exposure.

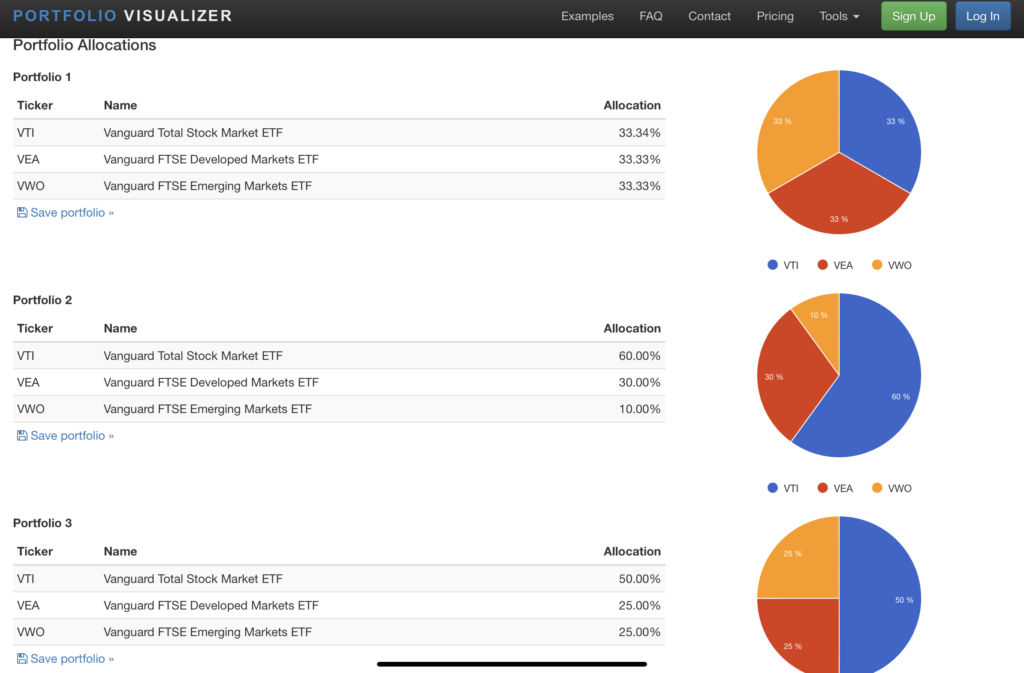

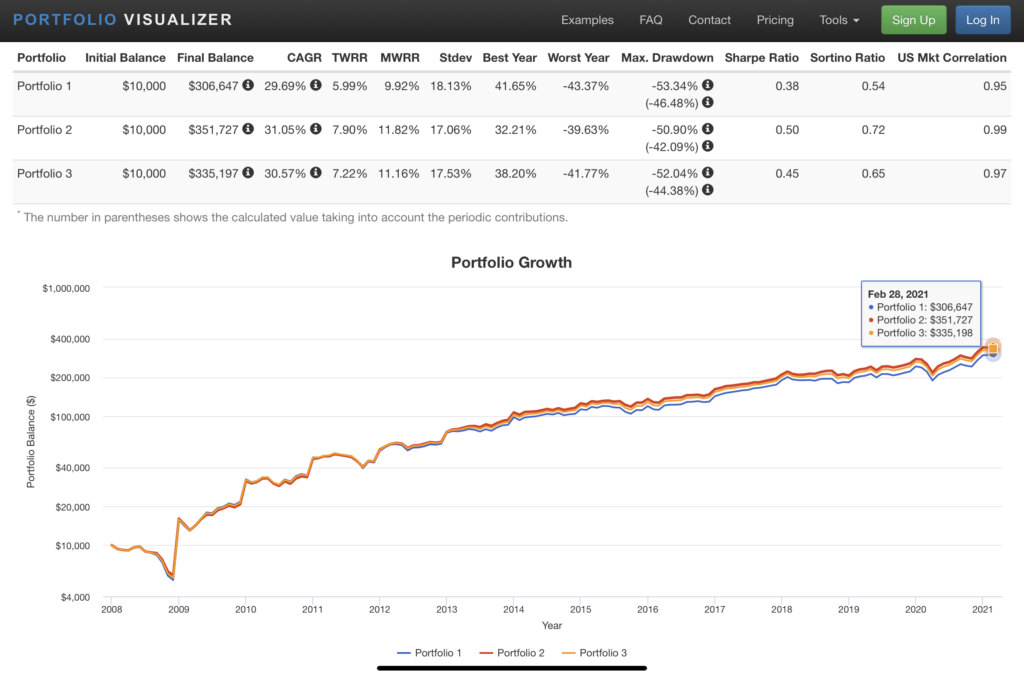

These 3 ETFs (VTI, VWO, VEA) effectively get you exposure across the whole world. From a risk perspective, VTI is probably the least risky given this is US exposure, then followed by VEA and finally VWO because those countries are developing. The next part of balancing a portfolio is all up to you. We’ve run some portfolio back tests beginning from 2008 and we recommend running some tests as well (but remember past returns are no guarantee of the future).

If you’re willing to stomach some serious risk, it may be worth weighting the portfolio with more VWO exposure, but either way, this portfolio is pure stock exposure so risk is already relatively high compared to what target date funds have (they usually always have bonds). At crazyfinances, we have a long term mentality and are willing to stomach the turbulence in the market given stonks only go up in the long run 🙂

We know many of you are also individual stock pickers (we like to pick as well) and may just yolo Tesla options to the moon, but it’s always nice to have something to fall back on. If that doesn’t work, the lazy portfolio is a great methodical wealth builder.